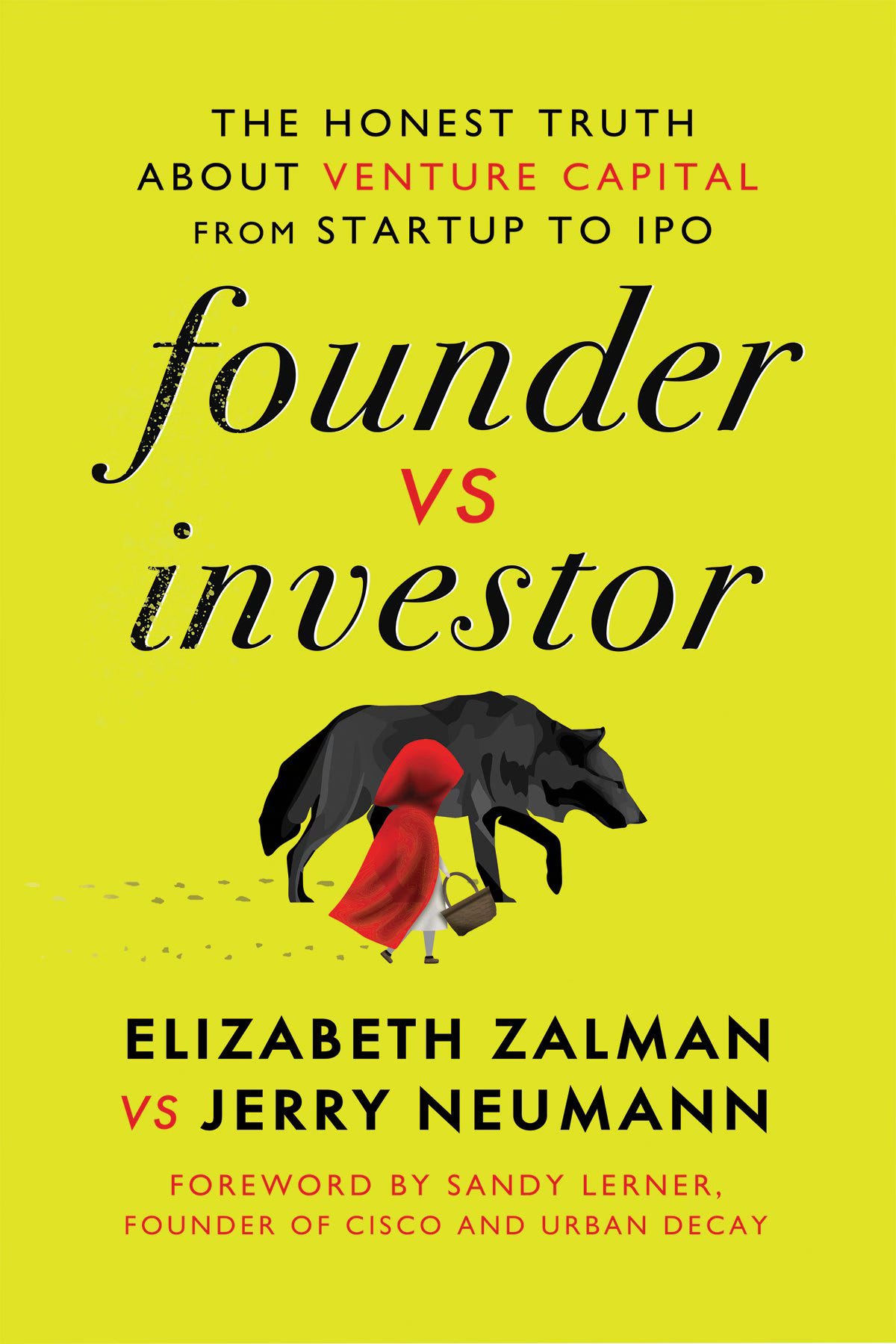

"founder vs investor": A Radically Candid Assessment of a Relationship Fraught with Friction

This book tells you what most won't: it is brutally candid about how the relationship between Founder and investor is inherently fraught with friction. A must read for any Founder courting VC money!

Reading “founder vs investor”, it is difficult not to like Elizabeth Zalman for her plain outspokenness and radical candor.

She counterbalances what for too long has been a unilateral narrative of VC being “founder friendly”, i.a. calling Board Meetings a waste of (everybody’s) time, highlighting countless booby-traps in a term sheet and deal dox, and generally warning founders to not sleepwalk into becoming “VC worker bees” who hand over their company’s - and personal! - destiny to investor overlords.

There’s a certain fatalism in the book that concludes that for a company to grow fast, accepting the Faustian pact with VC is inevitable.

Whilst this may be true for Web2, we believe Web3 (which is not mentioned at all in the book) will ultimately find a way to disrupt the VC model and lessen the dependency on “centralized capital” by raising from the community at large - as long as securities laws don’t stand in the way!

However, also for Web3 founders, who we see increasingly courting Web2 style VC investors vs. raising purely by way of a token sale, this book should be a warning to go into the VC relationship with open eyes and be realistic about the best once can hope for and the worst one should try to avoid.