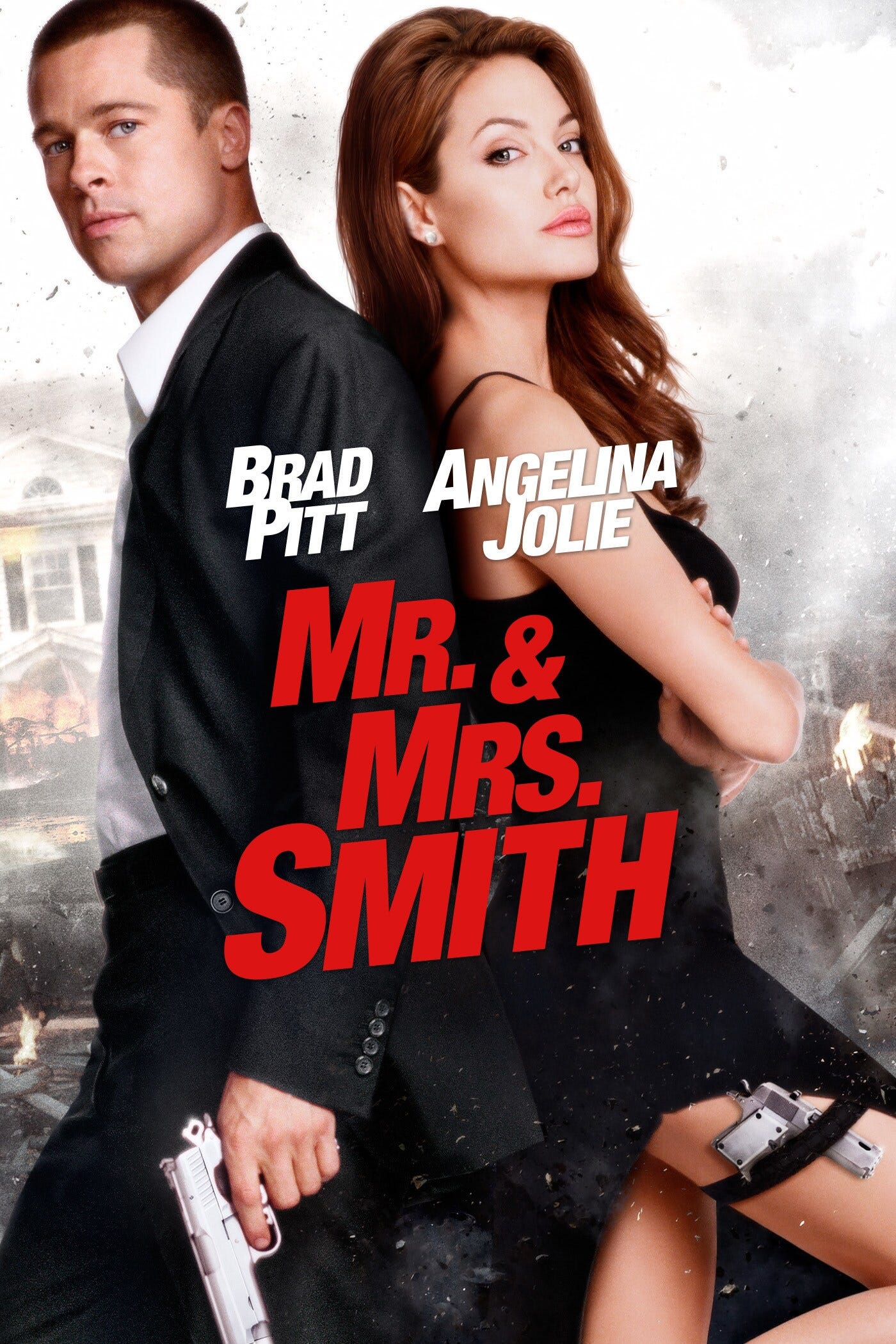

Dumb vs. smart contracts: How blockchains could have prevented a court battle between Brad and Angelina over a French vineyard

Yesterday's Hollywood dream couple is in court (again) after Angelina allegedly sold her share in a French vineyard without Brad's consent. If only they had coded their agreement on blockchain.

Killing each other

In its June issue, Vanity Fair came out with a painfully detailed account of the recent acrimonies between former Hollywood dream couple Brad Pitt and Angelina Jolie.

This time, he sues her for allegedly having sold her share in Miraval, a prestigious French vineyard which they jointly owned, to an outside bidder without his consent.

Anybody who’s ever been part of a shareholder agreement will immediately recognize that such a sale is typically dealt with under a Right of First Refusal (“ROFR”) clause.

Simply put, such clause gives existing shareholders the right to buy a fellow shareholder’s shares at the price he/she has been offered by a third party. It works like a call option as there is no obligation, except by the shareholder who is desirous of selling to show the price he/she has been offered by a third party to his/her fellow shareholders.

According to Vanity Fair,

“Eight days before the deal [to acquire the vineyard in May 2008] was signed, Jolie’s business manager suggested adding a doomsday clause stipulating that, should the couple ever split, each would have the right to buy the other’s share of Miraval. Pitt rejected the idea, according to her cross-complaint, telling his business manager it “wasn’t necessary for two reasonable people.” However, as a by-product of their supposedly everlasting love, he would insist that he and Jolie later made a pact agreeing never to “sell their respective interests in Miraval without the other’s consent.” It was a promise Jolie would deny, claiming “no such agreement ever existed.”

Less than thirteen years later, in January 2021 and with their marriage on the rocks, Jolie emailed Pitt she wanted out: She would either join him in selling the whole thing off, or she would accept “a complete buyout of my share in the property and business”, according to the email.

Allegedly, Pitt opted to buy her half of Miraval, and in February 2021 they agreed that he would pay Jolie $54.5 million for her entire interest, including undistributed profits.

Tit-for-tat

However, an ancillary dispute over a non-disclosure agreement as part of the increasingly ugly custody fight over the couple’s children scuppered the deal.

Jolie subsequently petitioned the court to lift a restraining order so she could sell her stake to a third party and in October 2021, she sold the company that held her share in Miraval to a drinks company controlled by a Russia-born billionaire by the name of Yuri Shefler.

Jolie claims she had every right to sell her share and claims she looked for and found what she believed would be a good business partner for Pitt.

However, he reportedly felt betrayed and saw it as a tit-for-tat by Jolie after he was awarded 50-50 custody over their children.

Allegedly, Pitt had no knowledge of Jolie’s decision to sell until it was reported in the press. According to Vanity Fair,

“Four months after the sale was announced, Pitt filed a lawsuit seeking to nullify the sale of Jolie’s 50 percent of Miraval. He insisted she had no right to sell 50 percent of Miraval since they had each agreed not to sell without the other’s consent and were entitled to a right of first refusal over any sale. He argued that Jolie’s sale of her half of Miraval was “unlawful,” and he demanded damages […]”.

From ROFR analog wording to multi-sig digital wallet

Let’s now transpose the above to a world in which lawyers learned solidity or received help from blockchain coders to author smart contracts that deal with this key clause in what is all by all a fairly standard business transaction.

Further down, we will then extend this analysis to the typical clauses in a VC-funded equity round.

First, in a smartcontractified world, equity in the company that holds Miraval would not only be tokenized but would also be smart: all business logic related to how the company that holds Miraval is governed and its corporate actions are embedded in the token itself, including transfer rights.

Such transfer rights would be enforced by the code itself, which would effectively lock the shares into a multi-signature wallet in which all shareholders have to co-sign any transfer.

These shareholders, in our case Pitt’s and Jolie’s respective private holding companies (Pitt’s is called Mondo Bongo, but what’s in a name…) would each have held 50% of the tokens representing shares in the company that held the vineyard.

If Jolie would have wanted to transfer the tokenized shares to Shefler’s wallet, her computer would literally have said “no”.

The existence of the code, for anybody to audit, would also have removed any ambiguity about whether or not a ROFR was agreed, which Jolie denies.

The smart contract could have been further refined to allow Jolie to unilaterally transfer out her shares to Pitt’s designated wallet (and only his wallet), and the transfer could have been automated by the smart contract checking the contents of a designated digital wallet in which Pitt paid the $54.5 million which he allegedly offered for Jolie’s entire interest. The only exogenous parameter of the contract would be the price.

Escrow out of the window

Such smart contract setup effectively replaces the need for an offchain, paper-heavy escrow arrangement which is still very common especially in real-estate deals, and for which lawyers and banks and other parties involved each extract rent.

Blockchains by their nature escrow funds and releases them according to the conditions embedded in the smart contract.

A blockchainified company would offer countless further advantages over an offchain setup:

3D accounting, in which all income and outgoing expenses related to Miraval would have been in digital currency with blockchains keeping track of both, would have prevented disputes between Pitt and Jolie about how much each invested in Miraval after their joint purchase, with Pitt claiming - and Jolie disputing - that he “poured millions“ into the vineyard, and Jolie representing she had invested “some $60 million of her own money into it over the years” (which Pitt’s lawyers contend was actually $38 million).

All governance actions would have been entirely transparent and would have included a procedure to amend the very governance protocol of the company, probably via a unanimous or at least qualified-majority vote onchain to change its bylaws.

Any bids received for Jolie’s shares would have been staked by Shefler in a dedicated wallet as proof she received a valid offer and that he actually had the money to buy her out. Consequently, if Pitt would have chosen not to exercise his ROFR (by signing it away in an onchain transaction using the private keys of Mondo Bong’s wallet which only he as its owner controls), Shefler’s staked monies would have automatically gone to Jolie in return for her shares.

Offchain acrimony

We have no doubt this is the way of the future, and it will power-law commerce and trade.

What it will not do is take offchain acrimony out of the equation, but then: smart contracts should not have the ambition to replace human foibles, which are of all times.

What they can do however is create legal certainty and replace the locus of enforcement from post-factum litigation to software-monitored prevention.

Beyond Miraval

In the above, we used the rather sad court spectacle between Hollywood’s former dream couple as a ludic example of how tokenization of company shares have the potential to transform routine business transactions and change corporate governance.

However, smart contracts’ killer app may well be capital formation, i.e. the way investors pool capital to acquire a Miraval in the first place.

Such pooling arrangements are typically much more complex than a simple joint holding or single asset transfer. Could the balance of economic and governance powers inherent in such deal documents ever realistically be embedded in code?

We believe they can and we will be using a typical VC deal as our guide.

The terms of such VC investment break down in two categories: economics and control.

Economics refers to the return investors will ultimately get in what is termed a “liquidity event”, usually defined as the sale of your company or the majority of its assets, but in a worst case could also mean its winding down.

Control refers to the mechanisms that allow investors either to affirmatively exercise control over the business or to veto certain decisions your company can make.

When they make in investment, they use analog clauses in the term sheet and deal documents to make sure they have both economic and control levers of power.

We will list the main clauses below and describe how they could look like if turned into smart contract code.

Before we do so, we need to talk about share classes, as different classes come with different rights, and these rights would have to be mapped to the smart contract.

Common stock is what founders and employees normally hold, while VCs and investors almost always receive preferred stock, which comes with special rights. The clauses we examine all relate to preferred stock, since this is how investors seek to protect the economics of and control in their investment.

In good and bad days

The following clause make up the economics of the deal:

Price

Price, as in valuation, will determine how much of your company you are selling and hence how much dilution you will take in the financing.

It will be a key variable, as it ripples through the mechanics of a number of other clauses but it could simply be oracled in or could even be hardcoded in the smart contract before it is deployed, since valuation is agreed with investors as part of any financing, unless you make it a take it or leave it deal at a valuation you set.

Once a pre-money valuation is set, a post money valuation is easy to calculate:

If say you raise $2MM on a pre-money valuation of $8MM, your post-money valuation is $10MM. Your dilution is 20% ($2MM/$10MM * 100 = 20%).

Option pool

The size of the option pool is inextricably linked to your company’s valuation. Whilst it will make a significant difference if the pool is added before or after investors come in (our view is that if a VC is founder friendly as they like to say they are, they should agree to add the pool after they invest, to dilute together with the founder team), for our purposes the size of there pool is just another variable that could be hardcoded or parametered at the time the smart contract is deployed.

Once an option scheme is agreed and individual allocations are agreed offchain, the mechanics of an employee option program including its vesting are a godsend use case for smart contracts: by simply setting the vesting commencement date, specifying the vesting cliff (typically one year) and the vesting schedule (typically monthly over the remaining 3 years), the smart contract can fully automate the pool and employees will literally see equity tokens drip into their designated wallet.

When they cease being an employee, the dripping also stops and they can typically keep the equity tokens already vested. In the case of a “bad leaver”, there may be a clawback of already-vested tokens, which on blockchain is problematic, so there may be the need for a staking wallet in which vested tokens are held until they can be exercised by the employee.

All this can be coded up: in one fell swoop (ok, a couple of dozen lines of code…), smartcontractified option pools would replaces reams of legal documents that word the terms of the option pool, the individual grants, the vesting terms, exercise notices, grant letters etc.

Liquidation Preference

After the valuation, the second big economic lever investors have is via their so-called “Liquidation Preferences”, which dictate how the proceeds are shared when your company is liquidated.

The Liquidation Preferences become especially relevant when the company is sold for less than the amount invested. To get a sense of how such preferences are worded in analog documents, here is a typical clause:

Liquidation Preference: In the event of any liquidation or winding down of the Company, the holders of the Series A Preferred shall be entitled to receive in preference to the holders of the Common Stock a per share amount equal to [X] times the Original Purchase Price plus any declared but unpaid dividends.

In above language, a certain multiple of the original investment per share is returned to the investors before the holders of common stock receive any consideration.

Such Liquidation Preference is typically accompanied (and often confused with) a Participation clause, which comes in 3 varieties: no participation (a.k.a. “simple preferred” or “non-participating preferred”), full participation, and capped participation, each with their pitfalls which do not need discussion here, except that a wrongly worded participation clause may leave entrepreneurs with nothing despite selling their company for millions!

For our purposes, even when companies sell additional series of equity and understanding how liquidation preferences work between the various series becomes mathematically challenging (especially for lawyers who author the series agreements!), the key point is that not only can liquidation preferences be coded as a series of conditionalities within a smart contract, but the code can help enforce the preferences and avoid ambiguities that could lead to very different outcomes, especially for entrepreneurs.

Simplified, the main parameter in such smart contract will be the multiple X of the Preference rights and what type of Participation is agreed. Upon liquidation, the only parameter the contract then needs is the sale price. Once plugged in, all proceeds could automatically flow to all stakeholders’ wallets.

Pay-to-play

Pay-to-Play essentially deals with follow-on rights for investors and becomes particularly acute in a down round, when a company raises at a lower valuation than its previous round.

The clause gives investors the right to invest (pay) ratably in future financings in order to avoid converting from preferred into common stock (playing) in the company, which would diminish their rights

Essentially, it disincentivizes investors from not participating pro rata in future rounds and is on balance good for a company (though it is by no means a guarantee that a company will be funded in future rounds!).

Here too, these rights and its mechanism could be mathematically expressed and protections for founders could be hardcoded that avoid one investor to force a recapitalization at a ridiculously low valuation if other investors don’t participate into the round.

Vesting

We examined vesting above in the context of Employee Options.

Typically, VCs also impose vesting conditions on Founder shares, which many entrepreneurs see as a way of controlling them, since it can lead to circumstances where investors can clawback their Founder stock. Such clawed-back stock is then typically reallocated ratably to the remaining stockholders, known as reverse dilution.

There are further “acceleration” clauses dealing what happens with vesting of founder stock upon an acquisition.

Many of the variables around vesting, acceleration and exercise period will be subject to heavy offchain haggling, however once agreed, the mechanisms of vesting and acceleration could be smartcontractified and automated on blockchains.

Antidilution

A final major economic clause is the protection investors typically seek against dilution in certain situations by way of an Antidilution provision.

More than any other clause, the Antidilution provision can be expressed mathematically, but dealing here with the difference between full ratchet, broad-based, narrow based weighted average adjustments to reduce dilution when the company raises extra capital is well outside the scope of this post.

Suffices to say that in addition to its economic impact, antidilution can also impact control, since it may lead to a reshuffling of the shareholder percentage holdings after a financing and therefore impact the governance of your company.

In what follows we look at some of these governance clauses in more detail.

Out of control

Control levers for investors are all about having a say in the actions that could materially affect their investment, given that typically they have less than 50% ownership and therefore can’t call the shots as majority shareholders.

The way they protect their investment is via a handful of governance clauses that in many ways are antithetical to the DAO model, using locks on votes and other protective provisions to secure their say in key matters.

Whilst such protective provisions may not be suitable for the governance of Web3 projects, that does not make such provisions themselves unsuitable for smartcontractification.

On the contrary, we see the use of smart contracts for corporate actions such as onchain board resolutions and proxy votes as an application of blockchains that may radically change how we coordinate governance in private and public companies.

In private, VC-funded companies, the key control clauses are:

Composition of the Board

A first control lever is the right investors will want secure to elect one or more Board member(s) to represent the holders of Preferreds.

Knowing that the Board almost always has the power to fire and hire the CEO, a Board seat is an important element of control.

Protective provisions

However, most likely (at least in early stage companies), investors will not control the Board, which will generally have the Founder, the CEO (or other Founder), and a VC as Board Members.

The way investors secure control over key Board matters despite not having control of the Board is by way of protective provisions, which effectively give them a veto right on certain actions:

Change the terms of stock owned by the VC;

Authorize the creation of more stock;

Issue stock senior or equal to the VC’s;

Buy back any common stock;

Sell the company;

Change the certificate of incorporation or bylaws;

Change the size of board of directors.

Pay or declare a dividend;

Borrow money;

Declare bankruptcy without the VC’s approval;

License away the intellectual property of the company, effectively selling the company without the VC’s consent;

Consummate an initial coin offering or similar financings; or

Create a token-based interest in the company.

The above list is fairly standard, and in all of these matters, consent from the VC would be required.

Board dramas

In a tokenized setup, a governance token would be created which maps to the specific privileges of the Board member who represents the Preferreds. Other Board members would be given similar governance tokens that map to their rights.

Such tokens would then be used in a governor smart contract that would check whether the holder of protective rights has consented to the actions in the above list (including a change in the list itself by way of a change in the bylaws).

The attractiveness of this tokenized setup is that blockchains by their nature become the minutes of Board meetings, so there can never be any disagreement at a later stage whether consent was actually obtained: All board actions are auditable and documented, and voting can be conducted entirely onchain.

Moreover, all painful analog formalities related to Board meetings, such as the convocations and advance notices, attendance records, quorum requirements etc. would be replaced by a couple of lines of code.

Drag-along rights

The drag along clause wants the common shareholders to vote with the preferred investors, giving the latter the power to force - or drag-along - all of the other investors and the founder(s) to do a sale of the company, regardless of how they feel about the sale.

A typical clause looks like this:

“Drag-Along Agreement: The [holders of the Common Stock] or [Founders] and Series A Preferred shall enter into a drag-along agreement whereby if a majority of the holders of Series A Preferred agree to a sale or liquidation of the Company, the holders of the remaining Series A Preferred and Common Stock shall consent to and raise no objections to such sale.”

A more recent variant deals with what happens when a founder-shareholder leaves the company, which then triggers the drag-along of his/her shares so he/she can’t play holdout after departure.

On a smart contract level, we see drag-along as a subset of onchain vote delegation, in which owners of a certain class of shares delegate the corresponding voting rights to the remaining token holders in specific circumstances.

Voting delegation on blockchains would also address proxy voting in public companies, which currently is full of archaic rituals including proxy letters and postal confirmations, and has resulted in a whole industry that charges a lot to manage the proxy process.

Preaching to the converted

Conversion rights

Finally, and supremely non-negotiably in any VC deal, are the investors’ conversion rights.

Simply put, it is a legal mechanism that gives the holders of Preferred Stock the choice to convert into Common Stock if they’d be better off doing so in a liquidation event.

In certain circumstances, such as an IPO over a certain threshold amount, such conversion will be automatic.

This threshold amount could be hardcoded in a smart contract (since in an analog setup the amount will be heavily negotiated and then inserted in the deal docs) and, upon public listing of the company, trigger the conversion.

Other

The above only touched on the key economic and control clauses in a VC-funded deal, and only very superficially so.

For instance, we did not talk about the specifics of the ROFR clause in a typical funding round, or super-founder rights (another one of those clauses that takes half a dozen of pages of legal prose but could be replaced by less then a dozen lines of code).

Case by case, we see a role for smart contracts to eventually replace the mechanics of how analog legal clauses currently trigger certain events, and substitute the often ambiguous logic of legal language with the certainty of onchain execution based on a limited set of variables negotiated and agreed offchain.

CONCLUSION

Bylaws as smart code will happen, but first a wider infrastructure will need to be in place:

Wallets are widely adopted by both retail and institutional investors;

Asset tokenization including stock is happening (which according to Blackrock’s Fink will be the “next generation for markets”);

Regulatory impediments to using blockchains as rails for peer-to-peer transfers of “DeFi securities” are removed.

Lawyers will still be in demand for their braintrust and to assist with offchain negotiations, but the deal mechanics and contract authoring will be done by smart contract developers (perhaps more realistic than expecting lawyers to start writing smart contracts…).

VCs need to put their faith in smart contract code rather than legal prose!

> OtoCo is turning companies into code, automating their formation, funding and governance with smart contracts. Follow its progress by joining OtoCo’s official Telegram channel.

NB - None of the main characters in this post could be reached for comment.