Bye to Sand Hill Road: An Ode and Epitaph to Venture Capital

Venture Capital is as much part of tradfin as banks and other centralized finance. In this post, we're proposing a new model that preserves the best of VC with decentralized venture building.

Scott Kupor’s “Secrets of Sand Hill Road” can be read both as an ode and an epitaph to Venture Capital.

On the one hand, it is an ode to the “wealth engine” built by VC and its central role in funneling funding to private companies.

In this light, it is genuinely an excellent book. It helps understand VC generally and some of the dynamics and incentives resulting from how VCs are in turn beholden to Limited Partners: their investor constituency of big pension funds, endowments and other institutional investors that allocate billions of dollars to VC funds as part of their portfolio diversification.

It also gives due credit to a group of people historically working from a cluster of offices on Sand Hill Road in Menlo Park, most of whom have built and exited business themselves, who over the decades have perfected techniques to help business overcome the biggest challenge of all: how to scale.

On the other hand, written in 2019, Secrets of Sand Hill Road may be the epitaph to a very 20th Century way of venture funding: industrial in scale, concentrated, and exclusive.

As with Mark Twain’s death, reports of the demise of VC may be grossly exaggerated.

However there are a number of factors that could accelerate its passing.

In what follows, we look at these factors more closely and examine what model may replace VC.

DC vs. VC

Decentral Capital (DC) is everything VC is not.

It is non-custodial, self-sovereign funding held in people’s wallets on blockchains, unlocked by a growing number of Decentralized Finance (DeFi) applications accessible from anybody’s computer.

The key difference between traditional finance (TradFin) and DeFi is the non-custodial nature of how wealth is stored in DeFi: participants are no longer dependent on gated intermediaries (fund managers, exchanges, bank accounts) to become financially active. Instead, all they need is a wallet on a blockchain.

Rather than endowments, pension funds, and institutional money, the investor constituency of DC is basically everyone.

This idea of “everybody their own bank”, combined with what has become known as the “composability” of DeFi, i.e. the way a user can connect and use the same wallet to access various and unrelated financial services and products on blockchains, is what is creating a new, permissionless financial system right before your eyes, in defiance of TradFin.

Next: Capital formation

DeFi first defied lending as we know it by letting wallet holders stake collateral and borrow against it.

Leading protocols such as Maker and Compound now hold billions of dollars in crypto collateral.

Exchanges followed, with decentralized exchanges such as Uniswap and 1inch where users can swap crypto assets without central clearing.

We believe capital formation is next.

The ICO days of 2017 gave a foretaste of the power of the crowd and new ways in which money from the masses can be mobilized.

ICOs raised grotesque amounts in seconds, and in January 2018, with the ICO wave at its crest, Vitalik shared the idea for a “DAICO”, essentially a smart contract brake on how proceeds of an ICO could be spent.

This research provided the basis for a number of experiments in what, only years later, would become a model for “fair launches”.

It was Andre Cronje who stunned the community when he launched yearn.finance with no pre-mine (i.e., no founder ownership) nor venture capital.

Within weeks, its $YFI token went from zero to over $30,000 per token and a $1 billion valuation.

$YFI is owned by its community of users, and everyone had a fair chance to receive $YFI tokens when they were first distributed.

Following this “immaculate conception”, $YFI can now be bought on most major and some minor decentralized exchanges.

In April 2020, Andre announced “Delegated Funding DAO Vaults”, inspired by Fair Launch Capital (manifestly not a VC, despite its name) as a “new kind of tooling” that lets founders borrow money from yearn.finance in an unsecured way towards their fair launches, mainly to help projects address the high cost of smart contract code audits.

How bull markets lead to bear development

Despite his and Fair Launch Capital’s appeal for “decentralized funding for decentralized finance”, DeFi projects have continued to pre-mine and pre-sell their token to a new breed of “Crypto VCs”: funds that invest in tokens of blockchain projects on behalf of their LPs.

In addition, traditional VCs such as Andreessen Horowitz have launched dedicated funds that invest in tokens issued by crypto protocols, in addition to taking equity in crypto-related companies.

Our thesis is that pure-play crypto VCs risk digging their own grave and may ultimate accelerate the disruption of VC as an industry as a whole.

Projects have been happy to pre-sell a chunk of their tokens to VC (from what we have seen at often very discounted prices) for the perceived stamp of approval and boost in marketing.

But many in the community are starting to question the integrity of this.

Many crypto VCs seem to skimp on due diligence or skip it altogether: Why bother if they can flip a token soon after its launch and pocket the gain, knowing that the very announcement of their investment will pump its token price?

In their defense, such behavior may actually be rational within the logic of a VC’s mandate. In a way, they do what’s expected of them: make money for their LPs (and get paid fees for doing so).

The result however is a token price that soon after launch collapses under the weight of massive dumping on retail investors.

Tradability is replacing liquidity

Quasi-instant tradability of tokens, often well before projects have matured (and in some cases before anything meaningful has been built) has come to replace traditional liquidity achieved by equity-based VCs when one of their portfolio companies files for an IPO or is sold in a trade-sale.

Such path to liquidity forced VCs to nurture their portfolio companies in order to realize a gain for their fund (barring the occasional secondary sale at various funding rounds).

It helps explain why the lifetime of a traditional VC fund is typically between 5 to up to 10 years.

By contrast, crypto projects achieve liquidity much earlier by trading on decentralized or even centralized crypto exchanges such as Coinbase.

Such tradability to a large extent removes the incentive for a VC to groom its portfolio companies towards a liquidity event.

It also undermines the case for the same level of due diligence compared to when investments are made for the longer term.

The road to serfdom

This is compounded by the absence of traditional governance levers VCs have when they invest in tokens, compared to them holding a company’s equity.

Such traditional levers include a Board seat, preference shares, and the general terms of their investment.

The main levers they are now left with are the restrictions on the vesting of founders’ token allocations as part of their pre-sale purchase terms.

In this respect, VCs typically retain the freedom to immediately trade a project’s token, whilst a substantial portion of the token allocation to founders remains locked up for an extended period of time.

Whilst founders are generally well looked after financially from selling or pledging their initial unrestricted tokens allocation (enough to suppress rebellion!), there’s no second helping: all of their future entrepreneurial gains will have to come from the token price.

As a result, entrepreneurs who are only (or mainly) in it for the money risk being worse off longer-term versus their peers who received equity funding the traditional way.

Arguably, such greedy founders get what they deserve. However, for founders who are motived beyond money, they may soon feel they’re on a road to serfdom: alone and abandoned by their early investors who long ago sold out, their liquid wealth still in lock-up, their code exposed to rug-pulls...

In both scenarios, the risk is that founders too will move on too soon and not stay the course: Why not repeat the same trick and go on pre-mining tokens in the next FOMO project, lock in a VC to boost the initial price, and sell your unrestricted tokens at the same time they sell?

If this is a cynical view, it is one frequently shared within the community. If scams increase in value as much (or even more so) as legitimate projects, legitimate developers become demotivated, leading Andre Cronje to conclude that “bull markets lead to bear developments”.

Countermovement

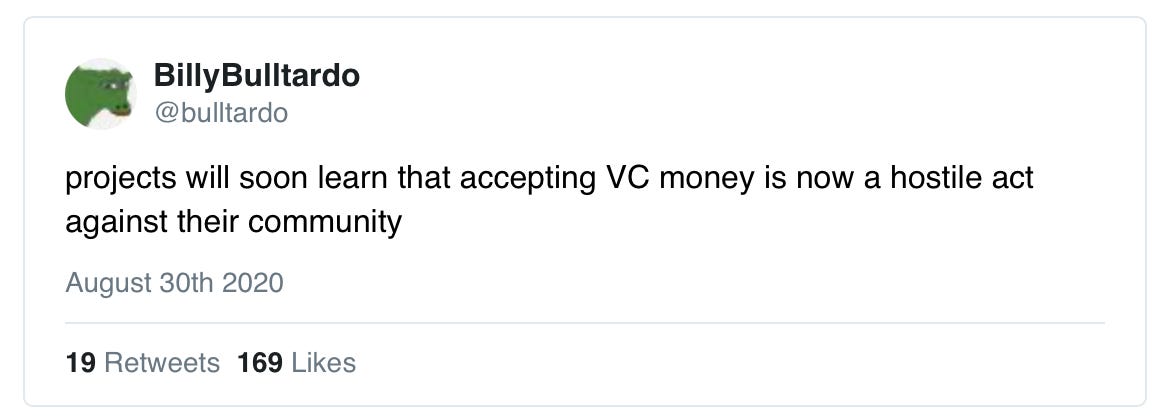

Some in the community campaign against accepting VC money altogether and want to see VC exorcised from any decentralized project.

This countermovement is a fair protest against crypto VC’s “rinse and repeat” practices described above.

If such hostility by crypto founders and the broader decentralized community continues to grow into some giant hidden iceberg of resentment, crypto VCs may have their last dance on the deck of the Titanic.

However it’s difficult to say when the iceberg will hit. Meanwhile, a good time is to be had by all!

Less rebellious voices see a role for VC but on an equal footing with other token holders, without preference or prejudice.

For instance, projects could go without pre-mines and pre-sales, but this may be naïve. In such scenario, VC would just become secondary buyers.

Alternatively, pre-sales could be conducted in a fair way, preventing anybody, including crypto VC funds, from becoming dominant token holders with the ability to swing the outcome of onchain votes or disproportionally influence the project otherwise.

Elsewhere in this newsletter, we look at token distribution mechanics that aim to prevent the capture of a project by token holders including VC.

Ah, we forgot about the intangibles

But what about the intangibles VC brings such as mentoring, contacts, help with hiring, operational and even the occasional emotional support?

Our contention is that these intangibles will eventually be looked after by way of token grants.

Already, we see many of our clients engage domain specialists - be it in marketing, community relations, operations, people management, coaching, legal and tax - by giving them grants out of their Foundations and making such grants subject to an onchain community vote.

What we haven’t seen yet is an onchain vote to decide whether or not to take VC money in order to benefit from its intangibles!

The idea that VC would become the supplicant for token grants - with vesting subject to clear milestones and OKRs - would dramatically turn the tables on an industry that got used to doing things on its terms.

However, such scenario only reflects a world that increasingly recognizes that entrepreneurs are the real heroes of the story, and that creativity and temerity should have the last word over money.

Rather than a demotion for VC, this model plays to its strengths: with capital increasingly commoditized and decentralized, founders will value intangibles such as network, marketing, industry insights, recruitment, research, guidance, mentoring and thoughtful counsel which VC typically brings to the table more than its ability to shovel in money.

When everybody can become a token holder, VCs become just another token holder

Arguably the bigger shorter-term threat to VC’s relevance is the temptation by LPs to become direct token buyers themselves.

It is not unimaginable that, once crypto VC funds become token holders just like anybody else, with their value-add compensated for by way of token grants rather than more favorable terms over other buyers, LPs get tempted to make direct investments in tokens without GP involvement. It’s so easy after all!

This may be a repeat of the active vs. passive fund management debate in the main markets and we’ll need to see how this plays out.

However, no doubt VC will eventually have its John Bogle moment.

Such trend may accelerate as a result of:

institutional-type investors becoming more comfortable holding crypto assets, and we see this happening right now with institutions and companies getting direct exposure to some of the main currencies such as BTC and ETH.

The GP/LP fund template itself changing beyond recognition by turning into decentralized capital pools that onboard investors onchain instead of managing subscriptions offchain, combined with a more community-driven investment process and smart-contractified payment streams. This “press a button launch a fund” is a blockchain use case Otonomos itself is actively working on.

Conclusion: Should Decentralized Projects Take VC Money?

On balance, our answer is yes, provided the money is on the same terms as everybody else under a fair token distribution model.

However more than the money, founders should put the right price on the intangibles VC can bring to help their project scale, and award tokens when they deliver on these.

Is it too much to expect VC to help decentralized projects that may ultimate disrupt VC itself?

If we get to such state of enlightenment, it would truly be an ode to VC’s enduring relevance and the quality of many of its professionals!

by Han

Han is Founder and CEO of otonomos.com. For all his sins, he started his career at Goldman Sachs which he left 2001 to build a number of ventures (some of which VC-funded). Since his last exit, he informally started to help various early blockchain and crypto projects with their entity setup, including Ethereum itself. This turned into Otonomos as a business and otoco.io as a further evolution of how projects could be formed, funded and governed in a decentralized world.